Both employees and employers should be aware of what a W2 employee is. The various employee classifications guarantee that they receive proper compensation and submit accurate tax returns.

Key Takeaways

- The IRS uses W2 tax forms to determine how much people were paid, what taxes they paid, and what taxes were paid on their behalf by their employer.

- W2 employees are what most people consider to be “traditional employees,” hired on a regular basis by a business to work every day for a salary or per hour.

- It can occasionally be challenging for employers to distinguish between W2 and 1099 employees. All 1099 workers are required to pay their own taxes, and the majority of them are hired on a temporary basis.

- Your W2 form must contain the necessary information in order to be filed; if you are a W2 employee, you must also submit copies of this form in order to file both state and federal taxes.

Table of Contents

What is a W2 Form?

Employers and employees both use Form W2 for tax purposes. This form contains details about the employee, the company, the employer, the employee’s yearly compensation, and the payroll taxes the employee paid.

A W2 form is a yearly summary of the wages received by an employee and the taxes deducted from their pay.

At the start of each year, each employee receives this form from their employer. When filing their tax return, employees use this form.

What is a W2 Employee?

A W2 is typically issued to a W2 employee each year as proof of payment and tax payments. The most common and established employee is this one. W2 workers are paid on a regular basis and are hired to work for an employer.

Filling out a tax form is not sufficient to meet the requirements for W2 employment. Employers must handle employee tax withholdings and pay for any mandatory insurance required by the state. They might be eligible for benefits and additional job perks. Their work is typically dictated by business requirements. W2 workers may work full- or part-time schedules.

As well as paying a minimum wage and giving workers the tools they need to do their jobs, employers are required to do so. W2 employees are generally subject to a right of termination at the employer’s discretion, but this is not always the case. If this isn’t the case, it’s possible that the worker is a 1099 hire who isn’t qualified for W2 employment.

When is the W2 Deadline?

Each year, you can begin filing your taxes as early as January 1st, but if you are a W2 employee, you frequently need to wait for your employer to send your W2 forms.

When it comes to sending W2s to all of their employees, employers are actually given a deadline. Employers need to send W2 forms to employees and the IRS by January 31st each year.

Contact the payroll department at your place of employment if you haven’t received this form by January 31 and want to find out what’s going on. It’s possible that they don’t have the appropriate information from you.

The general tax deadlines that everyone needs to be aware of on their tax preparation checklist are the other deadlines you need to be concerned about regarding W2 forms. Your taxes are usually due in the middle of April. However, you can confirm on the IRS website. Tax Day was moved by the IRS to May 17th this year. Check City’s tax services are available if you still have taxes to file this year. No matter how late you file your taxes, Check City’s tax preparation fees remain the same. In order to receive your tax refund sooner, you can even take out a tax refund advance!

How Does a W2 Employee File Taxes?

Employers are required to electronically or by mail submit an employee’s W2 forms to the Social Security Administration (SSA). This form informs the IRS of the employee’s pay and the taxes that were deducted for the year. The W2 information must be submitted by the employer to the SSA because it is used to calculate Social Security and Medicare benefits.

By January 31, businesses must send W2s to their employees. That doesn’t mean you have to receive the form by that date; they can mail it to you at any time. Before that time, if your employer chooses, they can send you a W2.

Certain boxes on your federal and state tax forms will ask for information from your W2 forms if you are an employee filing your taxes. assemble your W2s before completing your paperwork so you have them on hand.

Along with your paperwork, you must send the government copies of your W2s. You can upload your W2s to your online platform if you are filing your taxes electronically because the IRS needs to be able to access them.

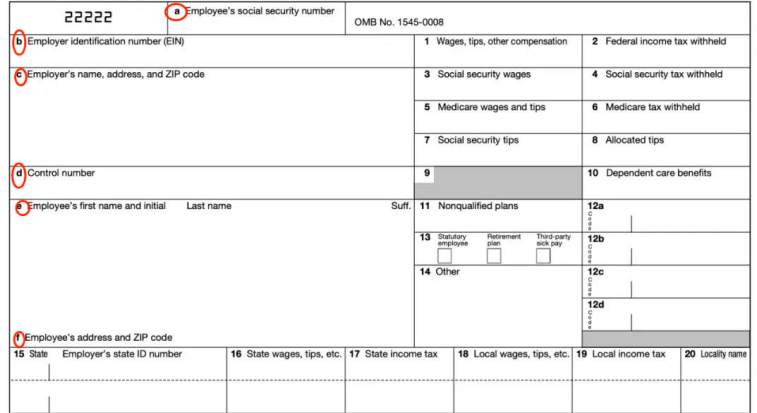

How to Read a W2

The lettered sections and the numbered sections make up the majority of the W2 form. Information about you and the organization you work for is contained in the lettered boxes. Information on your received income and taxes paid is provided in the numbered boxes.

All of these boxes are filled out for you by your employer, but if you use this form to file taxes, you might need to know a little bit about each section.

Always check to see if the details provided about you, the business, your earnings, and your tax obligations are accurate. Contact the payroll department at your place of employment if anything is incorrect.

Lettered Boxes on a W2 Form

(a) Personal Social Security Number (SSN) of the employee.

(b) The Employer Identification Number (EIN) of the company. Within the company, this number functions similarly to your SSN.

(c) The company’s official address. Sometimes, this may not correspond to your place of employment.

(d) The company’s control number for this W2 form. The payroll department uses this number to identify and file this particular W2 form. This box will be empty if your company’s payroll division doesn’t employ control numbers.

(e) The complete name of the employee. Your social security card and this form should both use the same name.

(f) The postal address of the employee.

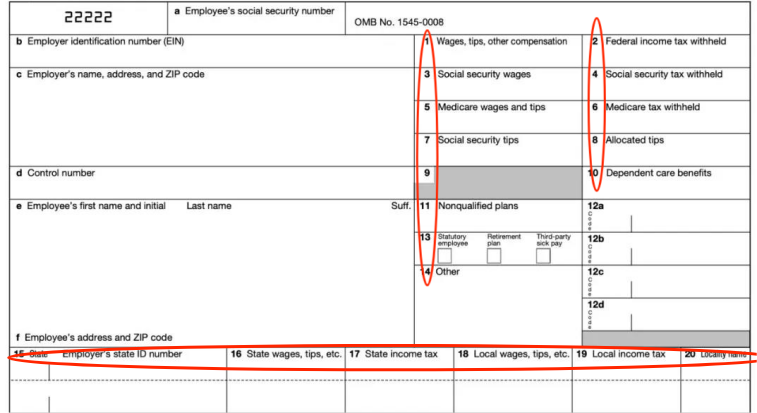

Numbered Boxes on a W2 Form

(1) The sum of all of the employee’s compensation from the company for that calendar year.

(2) The amounts of federal income taxes that the employee had to pay in that calendar year.

(3) The portion of the employee’s income that must be taxed for social security.

(4) The sum of social security taxes deducted during that year.

(5) The portion of the employee’s income that is subject to Medicare taxes.

(6) A measure of the Medicare taxes deducted in that year.

(7) The total amount of tips a worker reported to their employer for the year.

(8) The total amount of tips a business gave to each employee during that calendar year.

(9) For the verification code pilot program, this box was previously in use but is no longer.

(10) The sum for dependent care assistance programs that an employer has paid on the employee’s behalf.

(11) Amounts paid to employees under any nonqualified deferred compensation plans by the company.

(12) Employers can enter other unrelated items in this box using the W2 Box 12 Codes.

(13) This box shows whether a worker is a statutory employee, whether they took part in the company retirement plan this year, or whether they received sick pay.

(14) Another area for unrelated items in this box.

(15) State and state ID number of the business. Comparable to the business’s state tax ID number.

(16) the amount of income that must be reported to the state for tax purposes.

(17) the sum of state taxes deducted during that particular year.

(18) The amount of taxable income for any additional state, local, or local taxes, if any.

(19) The amount of taxable income that has been withheld this year for any additional state, local, or federal taxes, if any.

(20) What local, municipal, or other state taxes apply to boxes 18 and 19?

Difference Between a W2 and 1099 Employee

What a W2 employee vs. a 1099 employee. Although a 1099 employee is typically hired on a temporary and as-needed basis because they are regarded as self-employed, this isn’t always the case. 1099 employees are not regular employees, and the employer doesn’t have to take taxes out of their pay; they also don’t have to pay any taxes for the employee. Furthermore, they don’t get any benefits.

The majority of people categorize 1099 employees as gig workers, independent contractors, contractors, consultants, and freelancers. 1099 employees are responsible for paying their own taxes, and they receive a 1099 form to sum up their employment history for the year and to file with the IRS.

How Do Employers Classify Employees?

It can be challenging to identify whether an employee is a W2 or 1099 worker. Companies must accurately pay their employees according to IRS regulations. These three rules can be used to decide how to categorize an employee who may fall within the W2 or 1099 tax bracket.

- Behavioral. Does the company have any influence over the worker’s job duties, including where, when, what, and how?

- Financial. Do they receive a flat rate or monthly salary after submitting an invoice, or are they paid the same as all other employees and in the same amount of time?

- Relationship. Do they offer benefits to employees? Is the duration and term of employment specified in a contract? While W2 employees have open-ended terms, most 1099 employees have a renewal or termination date.

To be honest, some of these classifications, particularly the behavioral ones, are more difficult to define now that Covid-19 and the move to remote work have occurred. Many workers have the freedom to choose when, where, and how they want to work. The other two rules make it more clear, but this can be confusing.

FAQ

How Do You Determine If An Employee is a W2 Or 1099 Employee?

A W2 employee is hired for ongoing work, is eligible for benefits, and has some taxes paid on their behalf by the employer. Any taxes owed by a 1099 employee, who is self-employed, are their responsibility. They might also be employed by a company on an ongoing basis, but this is less common because they are frequently hired on an as-needed basis.

How to Get Old W2s?

The first thing you should do if you need old W2 forms is get in touch with your former employer and ask if they can send you a copy. You should probably get in touch with the payroll division. Whether it’s a mailing address or an online address, check to make sure they have the correct contact information for you. Some businesses mail W2 forms to employees, while others give you the choice to receive your W2s electronically. Reach out to the IRS at (800) 829-1040 if a former employer is unable to assist you in obtaining your W2s. Employers have until January 31st not only to send you a copy of your W2, but also to send a copy of it to the IRS. Therefore, copies of your previous W2s should also be on file with the IRS.

Can a W2 Employee Be a Part-time Employee?

Both part-time and full-time employment is possible for W2 employees. It doesn’t matter how many hours an employee puts in; the W2 classification isn’t based on that.

Can An Employee Change from a W2 Employee to a 1099 Employee?

Yes, W2 employees are classified in a temporary manner. An employee could leave their position as a permanent employee and switch to a contract position, and vice versa. For instance, if a business finds itself suddenly in financial difficulty, they may decide they only need a marketing executive as a consultant. On the other hand, a business may begin to prosper and decide to hire a freelance graphic designer full-time.

W-2 Form 2022 Revision: What Has Changed?

The IRS Form W-3: Transmittal of Wage and Tax Statements Form must be submitted by employers who are required to submit the IRS Form W-2. A W-3 along with Copy A of a Form W-2 must be submitted by employees to the Social Security Administration (SSA).

Take note: In 2022, you will have to submit W-3 forms electronically to the SSA if you need to send them 100 or more times. The number of forms will be limited in 2023 to 10. For more details, including options that let you file for nothing, see the Taxpayer First Act page.